My British Gas boiler cover is up £112 — what can I do?

Q. I have had boiler cover with British Gas for years but it is going up from £234.12 to £346.18 this year even though I have not claimed. It seems to me this is tantamount to extortion, not least because I was offered no chance to increase the callout excess charge above £60 to reduce the premium. The call centre had no explanation — can you help me to understand why the price has gone up so much when inflation is at about 2 per cent?Tom, Sevenoaks

Home emergency and boiler cover have come under the spotlight quite a lot over the past few years. Common complaints are about a delay in attending and resolving an emergency callout, or problems with repairs and damage that are not covered by the contract. Recently I’ve started to hear more objections about significant and unrealistic premium increases.

Customers opening their insurance renewals lately are likely to have taken a sharp intake of breath. Reports of up to 50 per cent price increases for motor, home and contents insurance policies are not uncommon.

• How to save money on your energy bill

There are lots of reasons why insurance premiums might increase, the most obvious being that you have made a claim in the past year. One of the most commonly cited reasons for price hikes in home emergency and boiler policies is an increase in the cost of repairs and raw materials. The age of your boiler or heating system can also make a difference— British Gas told me the price of cover might go up when the age of a boiler passes the milestones of 6 and 11 years.

The boiler model can affect the price if the manufacturer no longer provides spare parts to repair it, and the number of radiators in a property will also make a difference (the average is seven). Wider factors outside your control can also increase your premiums, such as the availability of engineers in your postcode and the number of claims made nationally each year and how much they cost your insurer.

• Compare energy suppliers

Insurers are under no obligation to explain precisely why the premiums have increased so much, which is a source of great frustration to customers. Requests for a detailed breakdown of the calculation are likely to be rebuffed, so it’s not easy to establish what you have to do to reduce your bill.

The problem with the home emergency, central heating and boiler insurance market is that there’s not a huge number of specialist competitors you can go to if you aren’t happy with your insurer. This leads to many people staying put. However, there are other options out there if you are being billed an unrealistic sum.

I know that you weren’t able to increase the excess, but for readers who can, this should bring down the premium, as can reducing the level of cover or choosing a more basic policy.

• British Gas left my 94-year-old neighbour in tears

Paying for a basic boiler or heating service or replacing an old boiler will make you a less risky customer and could reduce your premiums. If there are any unnecessary policy benefits that you don’t need then be sure to ask that these are removed too.

However, the best thing you can do to reduce your bills is to negotiate with your insurers and be prepared to walk away if they won’t lower the price. In your case this worked — you haggled on the phone and British Gas agreed to reduce your premium by £98, meaning the increase in your annual price was £14. It pays to ask.

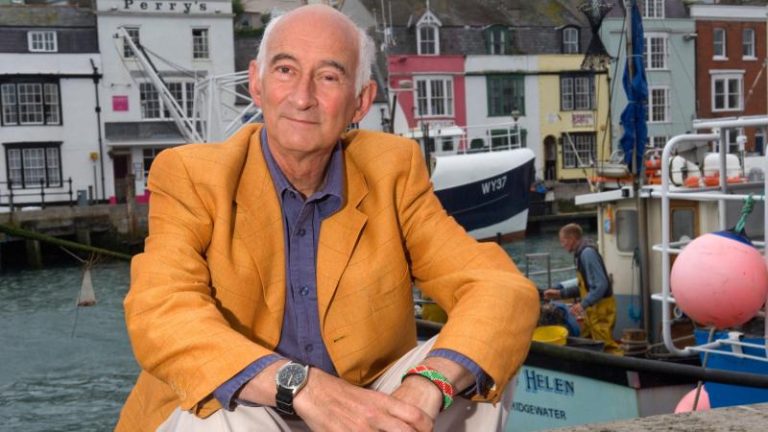

Martyn James is a consumer rights champion covering everything from energy bills to cancelled flights and pothole claims